Dear Clients and Partners,

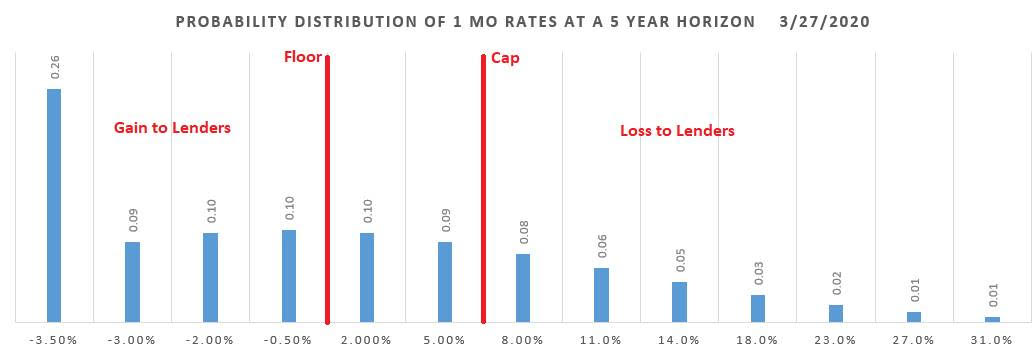

As the COVID 19 crisis deepens, the rate market moves into uncharted territory: as of last Friday, option prices suggest a 55% probability of negative rates. But how does this fear factor affect the capital market?

For simplicity, consider a stylized 5-year Adjustable Rate Mortgage based on a 1-month rate, 2% margin, with a floor and cap 2% and 7%, respectively. The 2% floor would have no value to a borrower who does not believe interest rates will become negative. Likewise, the 7% cap has no value to a borrower who believes rates will not rise above 5%, despite the historic global government monetary intervention. However, these beliefs contradict the capital market consensus today. As illustrated below, the potential loss and gain to lenders are significantly impacted by the specification of the interest rate structure. In a period of capital market turmoil, mispricing is abound.

In practice, the interest rate structure consists of the reset frequency, initial cap, periodic cap, and floor, adding complexity to valuation. An “arbitrage-free” interest rate model can ensure consistent valuation among a broad range of loans and investments. An ALM model using an appropriate underlying interest rate model is essential. By way of contrast, any model that artificially eliminates the possibility of interest rates falling below zero is not consistent with capital market prices.

Sign Up to see our free applications such as market rates, pricing, available loan offerings, and more!

You also can subscribe for our research papers and updates or read it here.

Best regards,

Thomas Ho

|